As part of a strategy to meet capital needs as well as global risk norms, from time-to-time the Bank aims to monetise certain assets by partially divesting stake in select subsidiaries.

During the year, we divested a part of our stake in SBI Life through a highly successful initial public offering. As the largest public offer in the past seven years, at the time of listing on 3rd October 2017, SBI has demonstrated remarkable ingenuity in creating India’s largest private life insurer in terms of new business premium (NBP) generated every year since FY2010.

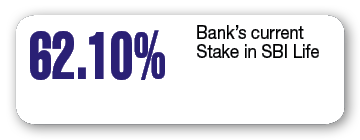

SBI sold 8% of its stake in the IPO of SBI Life valuing SBI Life at ₹ 70,000 crore, thereby enabling SBI to add to its capital to support growth. This IPO stands as a strong testimony to SBI’s capabilities in institution building and value discovery.

The Bank has many similar subsidiaries which have the potential to deliver future value. Over the years, the Bank has built value in various lines of business through its subsidiaries and investments in non-core assets. These non-core assets are fundamental to the nation’s financial markets’ infrastructure.